Such as the 30- and 15-year fixed and 5/1 or 7/1 ARM.Including fixed-rate and adjustable-rate options.Variety of popular loan types available.

Can get up to 100% financing on a purchase loan or refinance.It’s also possible to call your regional loan center, as noted above.Īside from basic military eligibility, keep in mind that a VA loan must be used for personal occupancy only (no investment properties), and can only be issued by qualified banks and lenders.

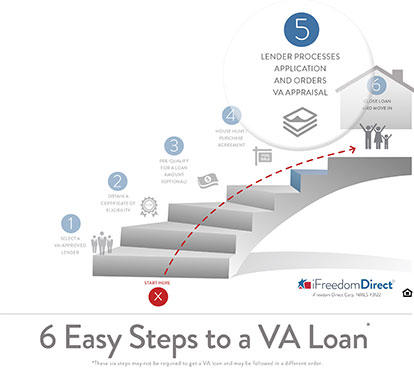

To prove eligibility for a VA mortgage, you will need to get a Certificate of Eligibility (COE) from the VA, which your bank may be able to complete for you. There is also a two-year requirement if the veteran enlisted and began service after Septemor if the veteran was an officer and began service after October 16, 1981. Veterans who served on active duty for 90 days during wartime, or 181 or more continuous days during peacetime are generally eligible. VA loans have varying eligibility requirements depending on the duration and type of military service performed. If you serve (active duty) or served in the Air Force, Army, Coast Guard, Marine Corps, Navy, or the National Guard, you may be eligible for a VA home loan.

0 kommentar(er)

0 kommentar(er)